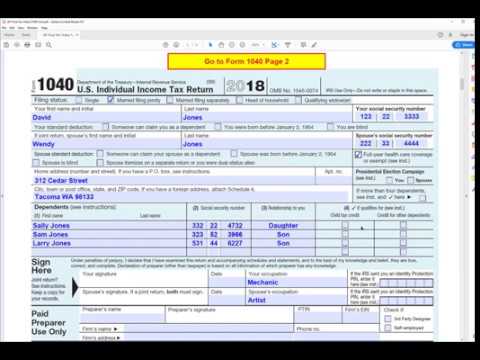

Hi, this is John with PDF tax. This is the 1040 form for 2018, which has changed quite a bit from 2017. We're going to go through this form and look at some of those changes. First, we want to fill out the name, address, and other personal information. I'm going to use autohotkey to automate this process. It works pretty well. Now, let's move on to the marital status. We have a married couple who will be filing jointly, so we'll check that option. They also have full-year health care coverage, so they don't have to pay the Obama care tax. Furthermore, their three dependents qualify for the child tax credit. Next, let's click here to go to page two where we can start entering some numbers. They have wages of $35,000 on line 1. Upon checking the instructions, we find that married filing jointly has a standard deduction of $24,000, which goes on line 8. Their taxable income on line 10 is $11,000, and based on the instructions, the tax on that amount is $1,103. Moving on to credits, they have a child tax credit. Part of it is refundable, and part is non-refundable. The non-refundable part goes in the designated spot. We know the amount is $1,103. Now, let's proceed to schedule EIC by clicking here. We will use autohotkey again to fill out this section. Here is our information for schedule EIC. Returning to page two, we find that the EIC amount is $4,182, which is entered accordingly. Based on the calculations so far, they are currently showing a refund of $4,182. Our next task is to work on the refundable part of the child tax credit. We need to refer to line 10 of the child tax credit worksheet, which is $6,000 for three dependents. Additionally, we take the amount...

Award-winning PDF software

1040 Tax Table Form: What You Should Know

If you don't have the Form 1040, fill it out online. Next, determine your tax rates. Your gross income is the sum of all your sources of income — wages, tips, and self-employment income. 1040 Tax Tables The table below shows your tax brackets for the year, from highest to lowest. Use the tables to calculate your total tax. We call that what you'll owe at the end of each tax year. You need to figure out whether you need to use estimated tax payments or a refund of overpayments if you don't make estimated tax payments by the time you file your tax return. Note: These tables are also for 2025 taxes. Your marginal tax rate means that, as you earn more, you'll pay more. Your tax table is for all the income you earn over your total federal taxable income — the line of your Form 1040, line 15, except for that portion of that income that isn't excluded from income (such as a capital gain). You'll use a different table at the end of the year if and when you determine a tax liability for the year, which you'll complete by using the tax tables at the end of the year. Taxpayers can use the tables to figure out their eligibility for various refundable tax credits, including the earned income tax credit (ETC); the child tax credit (CCC); and the credit for working with disabled individuals and their dependents. For more information, see Refund of Overpayments and Exclusion from Income. Taxpayers can also use the income-based repayment plan to pay all or part of their student loan payments and reduce the amount they owe on those loans. That program's refund is tied to reduced income tax. For details, see Federal Student Loan Programs. Taxpayers can also use the tax tables to figure out their income-based eligibility for all other tax credits, such as the standard deduction, the personal exemption, credits for charitable contributions, and the home mortgage interest deduction. For more information, see IRS Publication 525, Exemptions and Other Tax Benefits for Individuals and Sales of Charitable Contributions. The table below gives the amount withheld from your total income and how much is subtracted back to figure what you owe. For more information, see IRS Publication 502, Withholding of Tax and Estimated Tax, and IRS Publication 526, Taxable and Nontaxable Income.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1040 Tax Table, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1040 Tax Table online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1040 Tax Table by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1040 Tax Table from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 1040 Tax Table