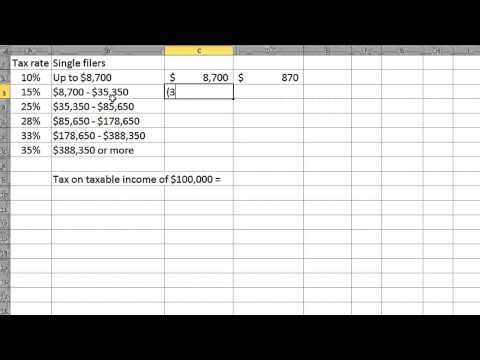

This video is going to demonstrate how to use tax tables to find the tax on a certain amount of taxable income. In this case, the taxable income is $100,000. These rates are specific to the year 2012. However, you may have different numbers to use, but the procedure will remain the same. Probably the most important thing to realize is that the tax on one hundred thousand dollars is not twenty-eight percent of one hundred thousand dollars or twenty-eight thousand dollars. That's not how taxes work. Instead, no matter how much money you make, the first $8,700 of it is taxed at 10%. That amount is $870. Next, you have a section of income between $8,700 and $35,350. Doing the subtraction, that amounts to $26,650, which is taxed at fifteen percent. Since this person's income is still above $85,650, the amount in that bracket, which is $50,300, is taxed at twenty-five percent. This results in a tax of $12,575. The remaining income, from $85,650 to $100,000, falls in the twenty-eight percent bracket. The amount in this bracket is $14,350 and is taxed at 28%. Only this part is taxed at 28% for a total of $4,018. If we add all of these up, we find that the total tax on $100,000 is $21,461.

Award-winning PDF software

Tax brackets 2025 calculator Form: What You Should Know

Federal Income Tax Brackets and Rates 2017, 2018, and 2019 Tax Call to Get the Right Estimate — U.S. Department of Treasury Use our Federal Income Tax Calculator to get your estimated tax owed. You can adjust your estimate for a refund later on the same page. Tax Calculators and Online Income Tax Calculators 2025 — eFile.com Calculate your Federal Tax using your 2025 or 2025 Federal Tax Parameters. How to Use One of the Best Tax Calculator & Online Tax Call Software 2017 You must use the tax calculator or online tax calculator and the tax calculator and online tax calculator does an excellent job at your tax rate calculations. How to Calculate Your Tax for Tax Season 2025 — TaxA ct Use our 2025 Tax Call above to get the taxes for 2017. You can also Use our 2025 Tax Calculator to get your 2025 taxes by entering your income tax bracket. Federal Tax Call for 2025 — TaxA ct Get your Federal Tax calls for 2025 below. How to Get the Taxes for 2025 Tax Year 2025 with our Online Tax Call Tool Federal income tax calculators for 2025 can be accessed from this IRS site. Here you can access the 2025 IRS tax calculator for a couple of things, such as calculating your tax for individual tax filing. Tax Calculators and Online Income Tax Calculator for 2025 — eFile.com If you are looking to calculate your tax for 2025 you can use one of the tax calculators and online income tax calculator below. Tax Calculator 2025 for Tax Season 2025 — eFile.com Use our current online income tax calculator for filing taxes for tax season 2017. All you have to do is enter the 2025 income figures, use our free tax bracket calculator to estimate your tax for tax filing and use our tax calculator to get the 2025 total tax. Catch your 2025 Tax Bill with our 2025 Federal Budget Adjustment calculator 2016 For 2016, a couple of changes to Income Tax law in Congress and in the United States government has made it essential for you to use our 2025 Federal Budget Adjustment (FBA) calculator, to get your 2025 federal income tax information. It may sound complicated, but you will still end up with the right amount of money for your tax bracket. We recommend the 2025 FBA calculator above! How to Use a Personal Tax Calculator and Personal Finance Software 2025 — TurboT ax You need to use TurboT ax, a personal finance software for tax preparation.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1040 Tax Table, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1040 Tax Table online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1040 Tax Table by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1040 Tax Table from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Tax brackets 2025 calculator