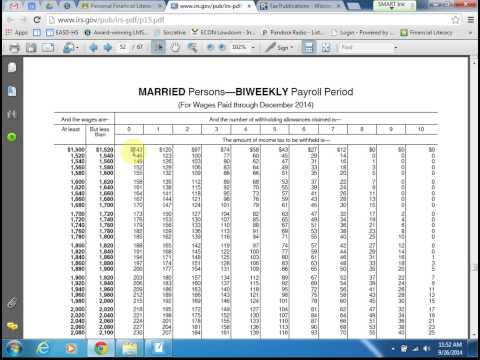

As we continue to move forward with completing the employee withholding sheet, we are ready to start working with the required taxes. Required taxes are things that are mandated by law to be deducted from your paycheck. One of these taxes is federal income tax. You will also be working with the tax tables for Social Security, which is 6.2 percent of your gross pay, Medicare, which is 1.45 percent of your gross pay, and state income tax, for which you will use tax tables provided by the state of Wisconsin. When working with these tax tables, there are four pieces of information that your employer will need to properly withhold your federal and state income taxes. These include your pay period, which is determined by your employer, your marital status, which you indicate on your W-4 form, your gross income, which is calculated by your employer based on your salary or the number of hours you work, and your number of allowances, which is also communicated by you on your W-4 form. The tax tables are organized based on these four pieces of information, with different sections for different pay periods, marital statuses, gross pays, and number of allowances. To use the tax tables correctly, first make sure you are looking at the section that corresponds to your marital status and pay period. Then, determine the amount you have earned for that pay period and find the corresponding row on the table. Finally, locate the number of allowances you are claiming, which will determine the amount to be withheld for federal income taxes. For example, if you are married and being paid bi-weekly, and you have earned $1,500 with three allowances, $74 will be withheld from your gross pay for federal income taxes.

Award-winning PDF software

1040 Tax Table 2025 Form: What You Should Know

Tax Brackets and Federal Income Tax Rates Feb 2, 2025 — There are seven tax brackets for most ordinary income for the 2025 tax year: 10%, 12%, 22%, 24%, 32%, 35% and 37%. If you have more than 200,000 of taxable income, a single filer must file a 2-page tax return each year. 2022 Tax Brackets and Federal Income Tax Rates Jul 2, 2025 – 2025 federal income tax brackets; 10%. 0 to 15,000. 10% of taxable income ; 12%. 15,001 to 74,999. 2,340 plus 12% of the amount over 15,000. 2022 Tax Brackets and Federal Income Tax Rates May 27, 2025 – 2025 federal income tax brackets; 10%. 0 to 21,660. 10% of taxable income ; 12%. 21,661 to 129,200. 1,950 plus 12% of the amount over 21,660. 2022 Tax Brackets and Federal Income Tax Rates Mar 31, 2025 – 2025 federal income tax brackets; 10%. 0 to 15,900. 10% of taxable income ; 12%. 15,901 to 74,999. 2,340 plus 12% of the amount over 15,900. 2022 Tax Brackets and Federal Income Tax Rates Mar 31, 2025 – 2025 federal income tax brackets; 10%. 0 to 15,900. 10% of taxable income ; 12%. 15,901 to 74,999. 2,340 plus 12% of the amount over 15,900. 2022 Tax Brackets and Federal Income Tax Rates Mar 31, 2025 – 2025 federal income tax brackets; 10%. 0 to 15,900. 10% of taxable income ; 12%. 15,901 to 74,999. 2,340 plus 12% of the amount over 15,900. 2022 Tax Brackets and Federal Income Tax Rates Mar 31, 2025 – 2025 federal income tax brackets; 10%. 0 to 15,900. 10% of taxable income ; 12%. 15,901 to 74,999. 2,340 plus 12% of the amount over 15,900.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1040 Tax Table, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1040 Tax Table online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1040 Tax Table by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1040 Tax Table from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 1040 Tax Table 2025