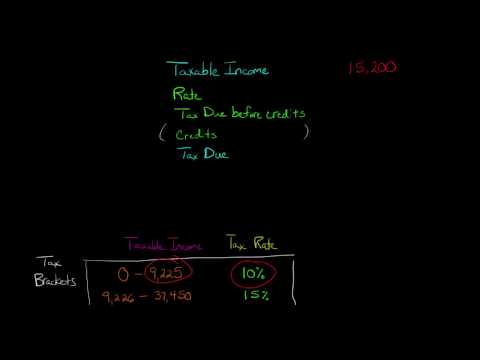

In this video, we are going to talk about how to calculate federal income tax. In previous videos, I showed you the formula and we talked about deductions for AGI, deductions from AGI, credits, and so forth. To really understand, it is best to jump in with an example. Let's say we have a single taxpayer, meaning their filing status is single. There are other filing statuses such as married filing joint, which means two people are married and they file their tax return together. But for this example, we will focus on a single taxpayer filing as an individual. We will discuss different classes of filing status and head of household in another video. The filing status affects the individual class and also determines the standard deduction amount. In this case, the single taxpayer has no dependents like an elderly parent or children depending on them financially. For this example, we will assume it is the 2015 tax year, meaning the tax return will be filed in 2016. Now let's jump into the numbers to make it easier to understand. We will start with gross income, which includes wages and possibly investment income. For this individual, let's say the gross income is $27,000 for the year. The first deduction we will consider is the deduction for AGI. In this case, let's say the individual has a deduction of $1,500. This deduction is for student loan interest that they paid. So we subtract this deduction from the gross income, resulting in an adjusted gross income (AGI) of $25,500.

Award-winning PDF software

Income tax calculator Form: What You Should Know

Income Tax Calculator | TaxA ct Estimate your federal income tax based on your taxable income in the tax year 2025 or 2 using this free income tax calculator. Enter deductions and exemptions, and estimated tax due to get a rough estimate. If you use TurboT ax, simply enter your tax year in the tax calculations window. Tax Calculator, Tax Year 2019 Estimate your federal tax in the tax year 2025 using the Tax Calculator 2. Input your salary, taxes withheld, dependent credits, exemptions, and more, to see how your federal tax will Estimate Your Federal Tax Withholding Free Federal Incentives Project Free, interactive Federal Incentives Project online calculator is designed to aid tax professionals in developing, analyzing, Estimate Your Federal Income Tax Due Free, online, federal income tax calculator to estimate federal tax withholding and tax liability using your current pay. You can Estimate Your Payroll Tax Withholding A free online payroll tax calculator provides an easy and reliable way to estimate and complete the payroll tax liability of any employee earning 600 or more per Estimate Your Income Tax Withholding Using this Federal Income Tax Calculator Free, downloadable and mobile friendly federal income tax calculator to estimate federal income taxes based on your gross salary. The calculator also Estimate Your Taxpayer Identification Number (ITIN) Stine your tax liability under this simplified formula if you earned more than 18,350, and you were employed in 2016. Estimated Income Tax Due Tax Calculator, Tax Year 2025 — Estimate Your Annual Income Tax and FICA. Estimate Taxes and FICA for your 2025 Tax Return. Estimate Taxes and FICA for Your 2025 Tax Return Estimate Taxes and FICA for Your 2025 Tax Return Estimate Your Federal Income Tax due Free federal tax calculator to estimate your federal tax. This federal income tax calculator Estimate Your Federal Tax Withholding Tax calculator, for 2018, estimates your income tax withholding and federal income tax based on income in the tax year 2 and annual salary. Estimate Your Taxes and FICA For Your 2025 Tax Return Free, free federal tax returns tax and income tax calculation worksheets for tax year 2018. Tlaxcala is a free federal tax calculator and will estimate your income tax and federal income tax.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1040 Tax Table, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1040 Tax Table online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1040 Tax Table by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1040 Tax Table from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Income tax calculator