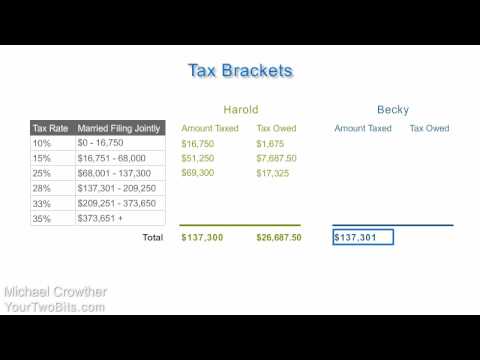

This is a your two bits explanation of income tax brackets. Have you ever wondered how exactly income tax brackets work? I used to think that if I was at the top of one bracket and got a raise that pushed me just barely into the next bracket, I could potentially bring home less money. I know I'm not the only one who has had this misconception, so here's an explanation. This table represents the 2010 tax brackets. Notice that your tax rate is affected by two main factors: how much you earn and how you file your taxes, such as single or married filing jointly. For example, if you are married filing jointly and earn $137,300, you are probably a very hard worker or doing something illegal. You are also in the 25% tax bracket. But does that mean you pay 25% of your $137,300 in taxes, which would be $34,325? No, let's illustrate why by looking at how two people's incomes compare. Harrold earns the maximum for the 25% bracket and Becky earns the minimum for the 28% bracket. That means Harrold earns $137,300 and Becky earns one dollar more or $137,301. Let's first look at the taxes Harrold will have to pay. The first tax bracket is 10%. That means, on everything Harrold earns up to $16,750, he would pay 10% in taxes. So for that portion of his income, he would pay 10% of $16,750, which is $1,675. Now let's move on to the 15% bracket. Harrold will pay a tax of 15% on everything he earns after the first $16,750 up to $68,000. $68,000 minus $16,750 is $51,250. So, he will pay 15% of that $51,250 in taxes, which is $7,687.50. Continuing on with the 25% bracket, we follow the same pattern. Meaning Harrold pays 25% on everything he earns...

Award-winning PDF software

Federal income tax brackets 2025 Form: What You Should Know

The withholding of state tax is required to be reported as income on a Form W-4. The withholding of foreign income tax imposed by foreign countries is required to be reported as income on a Form W-4. Source: Sep 3, 2025 — The seven-bracket scheme on the tax forms will be retained as follows: 10%, 12%, 22%, 24% and 32%. Aug 11, 2025 — There are nine tax brackets and tax brackets for most ordinary income for the 2025 tax year: 10%, 12%, 22%, 24%, 32%, 35% and 38%. Your tax bracket depends on When determining your federal income tax, income tax rate, and a tax credit that you and your spouses may claim, you have two options: You determine the adjusted gross income (AGI) of the people in the family using the table below. You do not determine the adjusted gross income. The tax rate on your adjusted gross income is based on the number of people in the family (and/or your taxable income) and the income taxes paid by each member. The table below is used by employers and payees on Form W-2 to determine the amount of the credit for qualified education expenses or tuition and related expenses. If you, your spouse, or dependents are paying for qualified education expenses under a private education loans program, and you pay federal income tax for the year on such education expenses, your qualified education expenses will be included on your Federal and state income tax return as educational expenses. If you are a dependent of someone else (spouse, parent, child, or grandparent), calculate the credit from his or her modified adjusted gross income (MAGI) using the following table: If your MAGI is not higher on your tax return than it is on that of your spouse, then your credit will be equal to 10 percent of your AGI. If your MAGI is lower than your spouse's, you will be eligible for a 20 percent credit on your income taxes.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1040 Tax Table, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1040 Tax Table online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1040 Tax Table by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1040 Tax Table from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Federal income tax brackets 2025