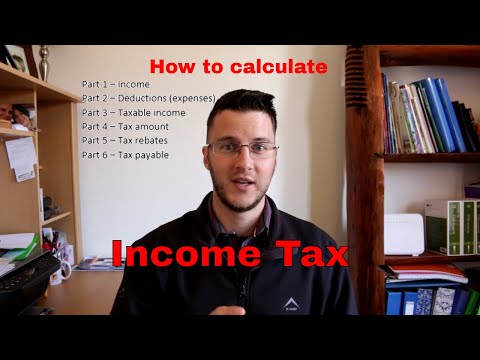

Albert Einstein said that the hardest thing to understand is income taxes. And in this video, I hope to make it a bit simpler for you. Music Applause Music. Welcome to this channel, my name is Jacques. I'm the host of Patera accounting services. And in this video, I'll be explaining what makes an income tax and how you get to the amount that you actually have to fight over to the South African Revenue Service. We are going to look at six parts in this video. Part one would be all the incomes that you have, and we'll have a quick look at the definition of what is income. What's the difference between income and gross income? Part two would be essentially your deductions. What deductions are allowed for a lot of people that consider this to be their expenses? Part three would then be to get to your taxable income. Part four would be calculating the actual tax amount. Part five is your rebate. And part six is essentially the amount of tax that you eventually have to pay or in some cases, that SARS has to refund you. And we're hoping for that, don't we all right? But one income can be defined using an online dictionary as money received for work done or through investments. In the income tax Act, it carries a slightly different meaning. Even though the term income is defined in section one of the Income Tax Act, the way in which the act itself uses the term causes a bit of confusion as to what exactly they mean by income. But one thing is certain, there is a specific definition with a list of items that are included for this definition. The term gross income is the total amount of worldwide incomes received...

Award-winning PDF software

Tax brackets 2025 calculator Form: What You Should Know

Tax Brackets for 2025 and 2025 (PDF) — Canada Revenue Agency Calculate your 2025 Federal Income Taxes here on Canada Revenue Agency. 2018 Federal Tax Brackets — 2025 Tax Year (tax year 2017) — Canada Revenue Agency This list is updated monthly. Use the below link to see your 2025 federal and provincial tax brackets.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1040 Tax Table, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1040 Tax Table online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1040 Tax Table by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1040 Tax Table from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Tax brackets 2025 calculator