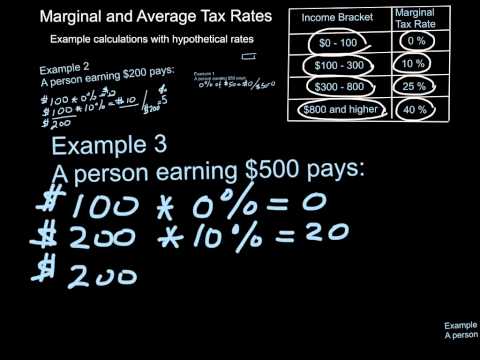

P>Hello, it's John Bauman again. We're going to do a calculation of average tax rates, and we're also going to calculate the actual amount of taxes paid by people in these hypothetical brackets. Of course, the actual rates are different from these, and you can see them in our textbook. The numbers here are small, and I'm going to keep them simple. To calculate the total amount of tax paid and the average tax rates is done in the exact same way, just with bigger numbers and slightly different tax rates. If you look at the table here, you can see that a person earning between zero and a hundred dollars is going to pay zero percent. So, if you're earning ten dollars or fifty dollars or ninety-nine dollars or a hundred dollars, you get a zero percent tax. Anybody earning over a hundred dollars is going to pay ten percent. However, that person is only going to pay ten percent on any amount that is greater than one hundred dollars. So, we're going to look at that in just a second with a calculation. Anybody earning between three hundred dollars and eight hundred dollars is going to pay a marginal tax rate of 25 percent. For earnings above eight hundred dollars, the tax rate is 40 percent. So, here we have four examples: one person earns $50, the next person earns $200, the third person earns $500, and the fourth person earns $1000. You can pause the video at this point and see if you can calculate on your own what kind of tax amount each person pays, and then also calculate the average tax rate. Let's start with the easy one, the person earning $50. Well, you can see that the person is in the zero percent tax bracket because the...

Award-winning PDF software

Federal income tax rate calculator Form: What You Should Know

Step 1 — Step 2 —.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1040 Tax Table, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1040 Tax Table online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1040 Tax Table by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1040 Tax Table from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Federal income tax rate calculator